What is the outlook of the Terra Luna 2.0? I’m going to explain why this token is not a good investment and you should not waste your money on Do Kwon and his project.

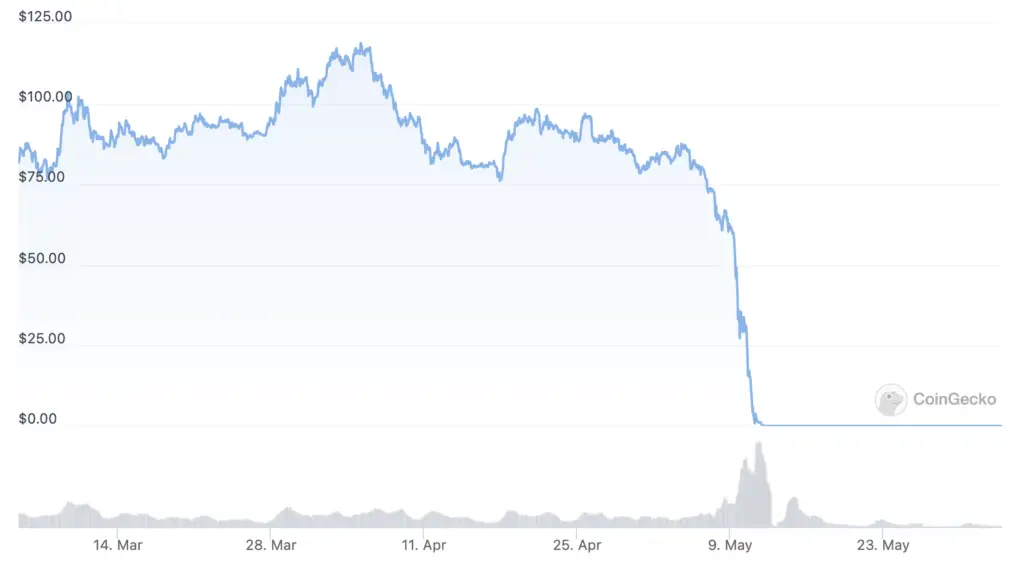

Many of you folk seem to forget about the Terra Luna crash 2 weeks ago. From $100 to $0 within 3 days WTF.

Well, guess what Do Kwon and his team have a brilliant idea… They just come out Terra Luna 2.0. Here are 3 reasons why you should not invest in this new project.

Before I can give you a reason I want to explain to you what the heck is Terra Luna 2.0?

This is the brand new token of the new Terra blockchain intended to rescue the Terra Luna ecosystem following the stablecoin collapse.

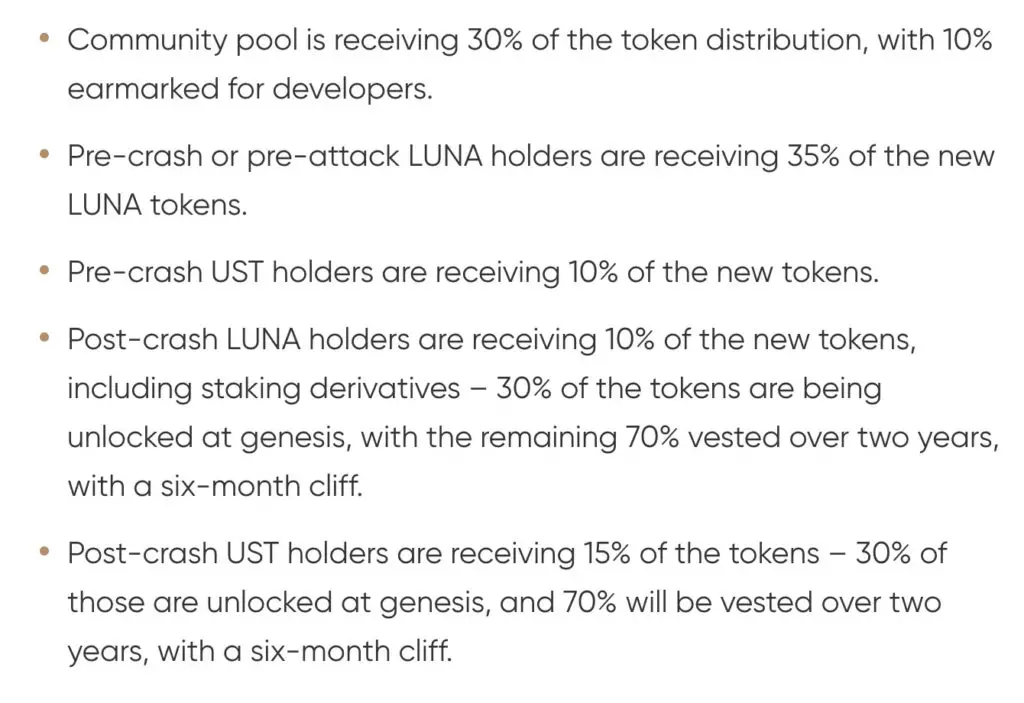

The old terra luna 1.0 was renamed luna classic. Here’s the game plan they going to do airdrop of luna 2.0 to the existing luna classic holder.

They will determine who gets the airdrop.

Reason#1: Uncertainty in LUNA 2.0 from future selling pressures.

Investors who lost money from the original Terra LUNA (luna classic) and UST will be receiving an airdrop of LUNA 2.0 tokens. A percentage of the airdropped token will have a vesting period whereby users cannot withdraw the token to sell it in the market.

In the short term, unvested airdropped LUNA 2.0 can be sold in the market. In hindsight, this has happened as early receivers of the airdrop dumped the token to recuperate their losses from the old LUNA.

In the long term, airdropped tokens unlocked from vesting could still be sold into the market. But who knows what will happen by then.

Reason #2 Do Kwon is running a whole show.

the terra rebirth is still run by Terraform Labs with Do Kwon under its helm. Even before the collapse of Terra, Do Kwon has been a controversial person. If you want to know more can watch ColdFusion video he explains really detail about this gentleman.

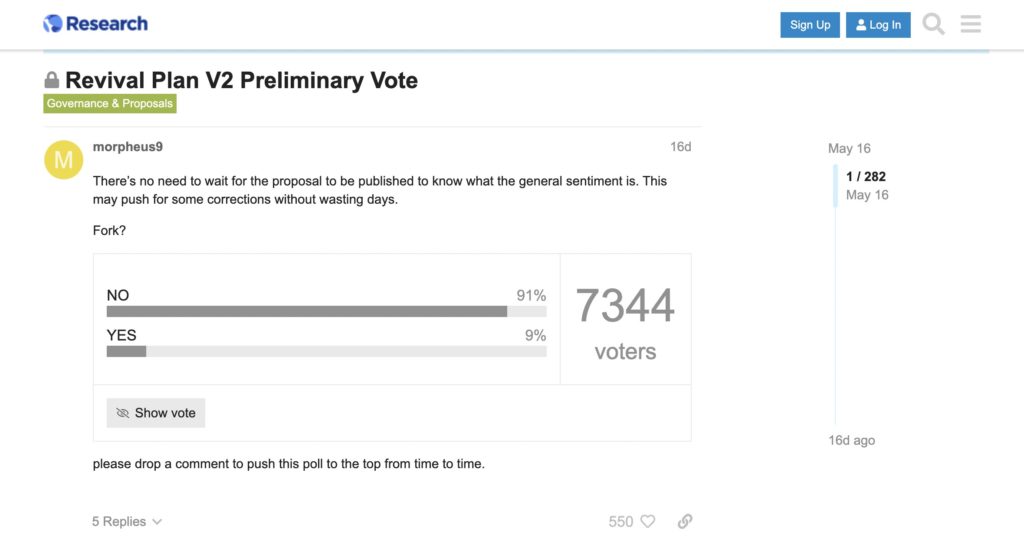

According fortune, Do Kwon’s proposal for a Terra blockchain ‘rebirth’ just passed by 65%

That’s far from true. Kwon and Terraform Labs pushed the vote forward despite an earlier online poll to the community.

Before Terra Luna, Do Kwon worked on a failed project called Basis Cash, an algorithmically backed stablecoin like UST. Yes, Do Kwon’s supporters may argue that projects do fail and people are not perfect, and it is how we learn from them.

However, it does not seem like that to me. If you fail one project, you tend to do better the other one. Now there are two failed projects you can see there is a pattern like a crypto honeypots scam.

His former employees even stated that Do Kwon is a dictator. He micro-manages his employees and has the final say on all decisions made by Terraform Labs. It looks like Elizbeth Holm 2.0 this time male version in different countries.

I think you should think twice to invest in his project.

Reason #3 Terra Luna 2.0 is a hard fork from Luna Terra 1.0

You know what fork means right? it is like you copy and paste the same project code but change a different name.

Terraform Labs pitch itself to have the best-decentralized money market? Without the money market, LUNA 2.0 is just like other Layer 1 chains in the market.

There are already a ton of established layer 1 projects in the market. Projects like Solana (SOL), Avalance (AVAX), Polygon, Fantom, Harmony and even the upcoming merge of Ethereum 2.0 are already well established and adopted to serve the community and enterprises.

Source: