Blockfi review in 2021 how to earn interest on cryptocurrency assets. This tutorial will explained loan, withdrawal, credit card and sign up an account.

Did you know that it’s possible to earn interest on your crypto coins? Or take loans against them? If you want to do more than just holding cryptocurrency, you’ve probably heard of a website I’m about to share with you.

But before you commit to this platform, you probably need to get more information about it and make sure it’s legit.

In today’s article, we going to talk about Blockfi Review how to earn interest on cryptocurrency by the end of this, you will know how does it work? How much they pay you? And important of all is it really worth your investment or not we about to find out so sit back relax and drink some coffee.

What is Blockfi?

Blockfi is a one-stop-shop wealth management platform focusing on crypto assets. It allows you to not just buy them, but also earn interest on them, take a loan or trade your cryptocurrencies.

Crypto assets BlockFi supports:

Bitcoin, Ethereum, Litecoin and USD stablecoin

How does it work?

BlockFi focused mostly on its BlockFi Interest Account AKA (BIA). With a BIA, you could deposit money into the platform and then earn interest while you are holdings. People are paid to borrow money from BlockFi, and the system generated consistent profit for you.

A quick note here: Blockfi acts like your bitcoin savings account platform. You could not earn anything interest if you hold your coin in coinbase or binance. You just held bitcoin, spent it as needed, and left it in your wallet. That’s why Blockfi is so different.

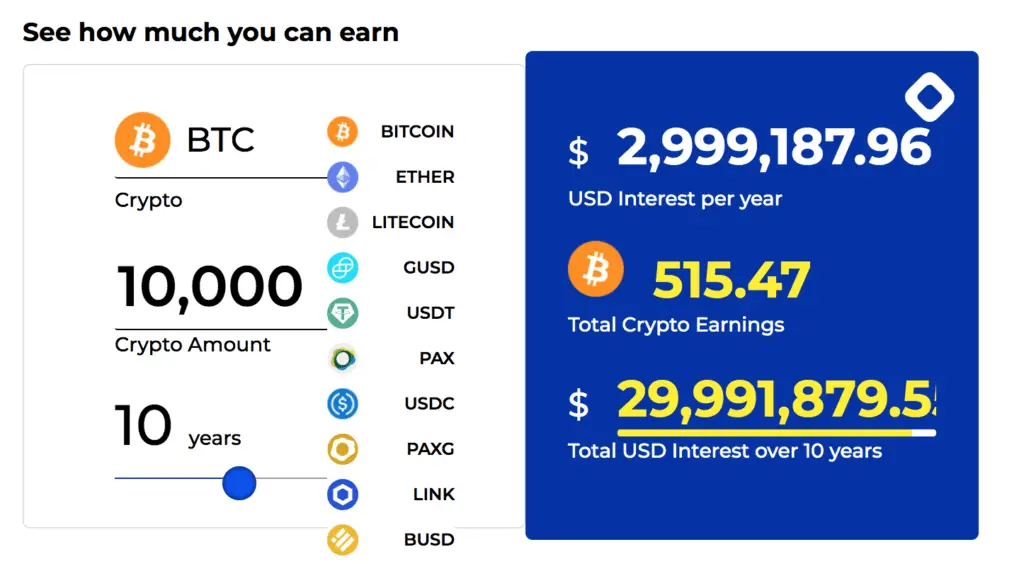

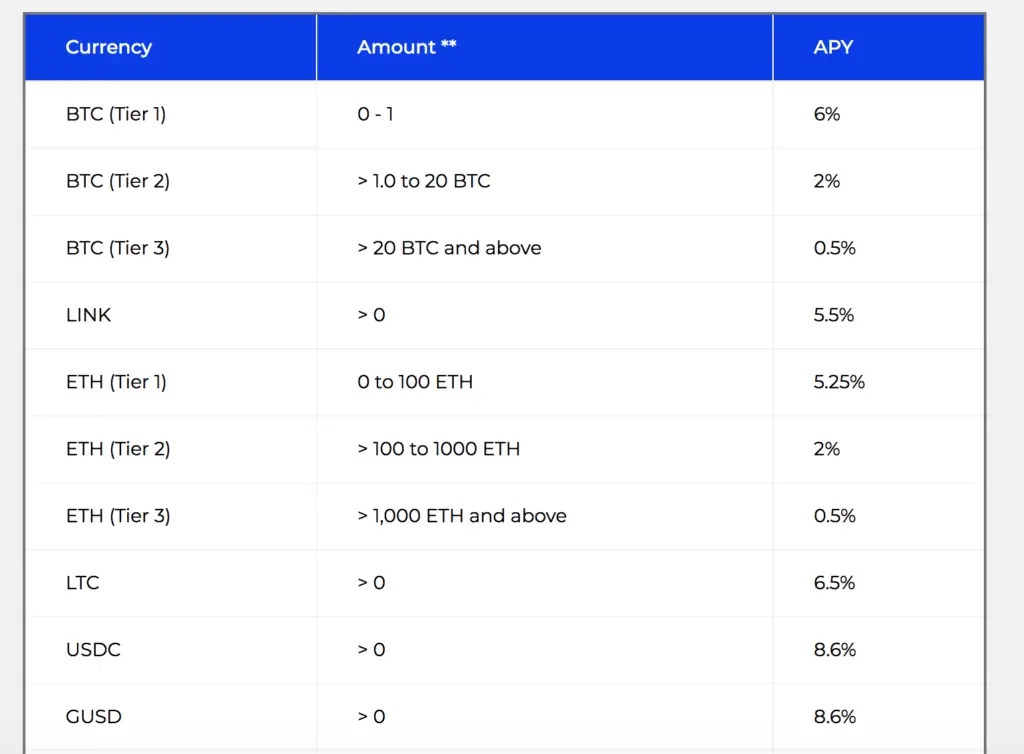

Here’s the BIA current interest rates:

Bitcoin is 6%

Ethereum is 5.25%

LTC is 6.5%

And most of the US stablecoins is 8.6%

Even if you don’t own any of the above-mentioned crypto coins, you can wire USD into your BIA. This way, your USD will convert to stablecoins (USDC, GUSD, or PAX) and you’ll be able to earn interest on those currencies.

Beside BIA there are two more blockfi service have to offer the first one is call blockfi crypto loan.

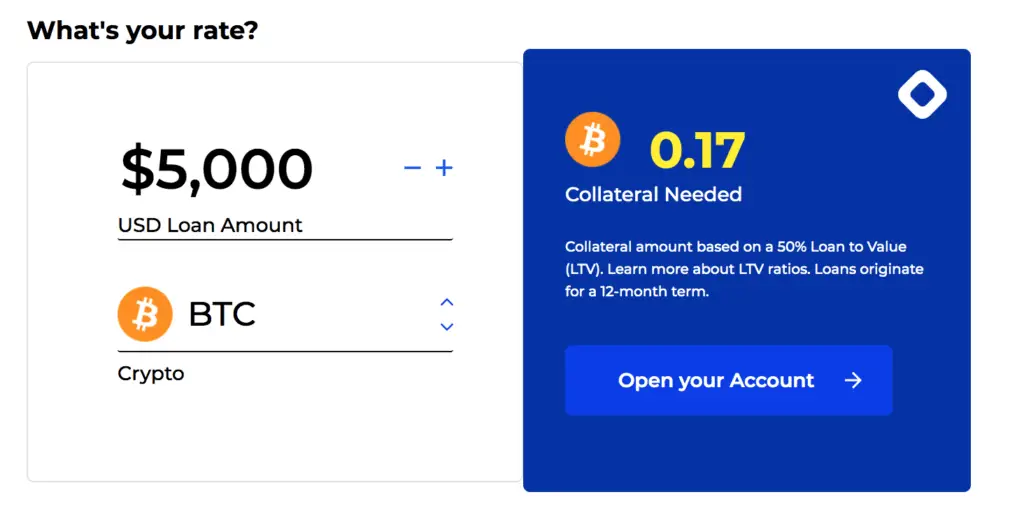

So, what is that mean? It’s meaning you can borrow USD against your coins on deposit. To take a crypto loan, you can use BTC, ETH, LTC. The minimum loan amount is $5,000 and the loan duration is 12 months. Plus, the interest rate for your loan works out to 4.5%.

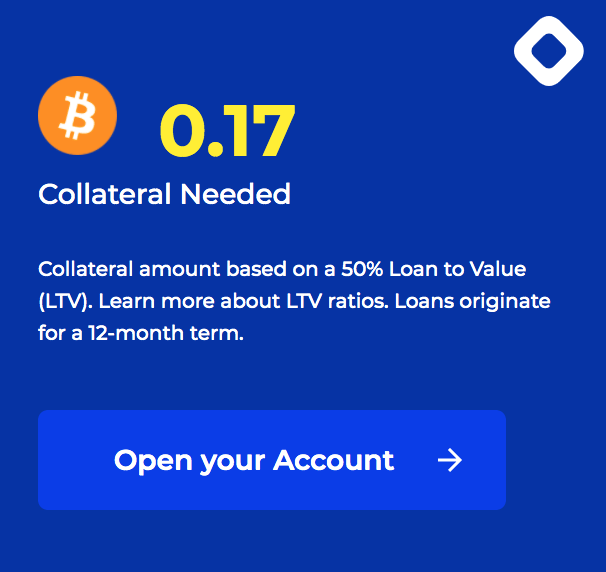

If you pay attention these little texts right here, The LTV (loan-to-value) ratio is 50%, meaning 50% of your coins need to be put up as collateral.

If you are borrowing $5,000 today, you need to put up 0.17 BTC as collateral on a 12-month term. Let me give you the example: If 1 BTC is worth $30,000, for example, then you would need to put up 2 BTC as collateral to borrow USD 30,000 from BlockFi.

It would be best to track your collateral to ensure it never falls below the 50% LTV ratio. BTC prices fluctuate wildly. If BTC suddenly drops, you may need to deposit more BTC as collateral to secure your loan.

Another service blockfi offer is Crypto Trading

You can buy and sell cryptocurrencies and stablecoins within your BlockFi account at competitive prices. As soon as you make the trade, the crypto is in your account – which means you can start earning interest.

Why trade with BlockFi instead of your usual crypto exchange? Like coinbase or binance. BlockFi emphasizes instant transactions, better pricing than competitors, and immediate interest accrual.

How to sign up?

Sign up for this platform is simple and easy. Let me show you. You will need to enter your first name, last name, email address, and referral code (click here if you need it).

After that you will need to verify your personal information, for me, I just need to enter my phone number and they send me a text message and it is done. For you, if you live in a different country, not in the US you will need to upload ID card, passport, or driver license.

How much money can you make?

The platform offers you to open an interesting account with an APY of up to 8.6%, trade currencies or borrow money without selling your assets.

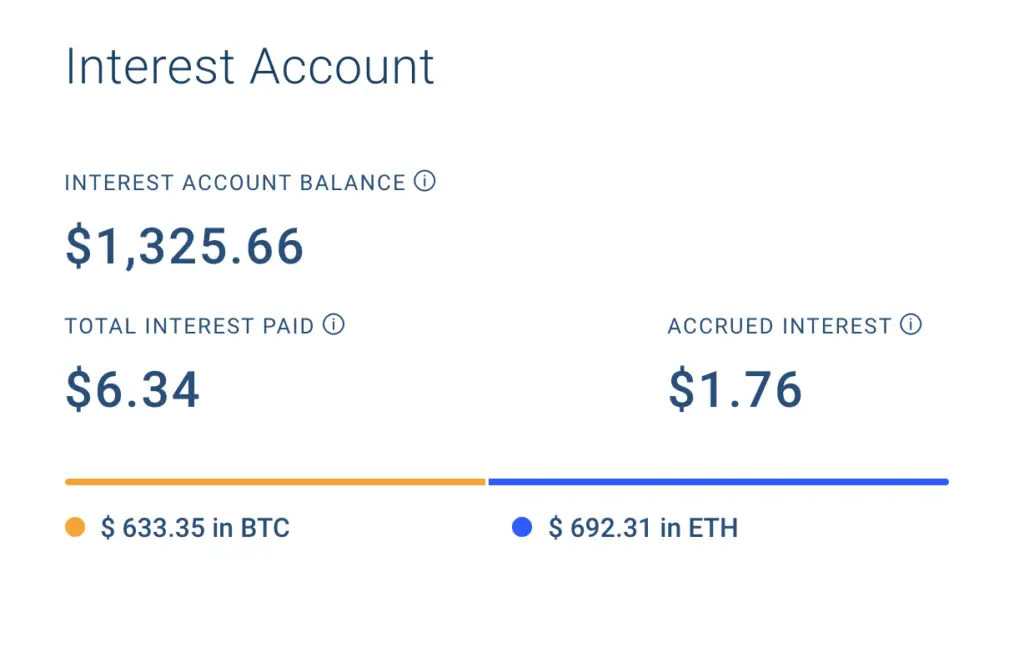

Let me show you how much I make to put in $500 bitcoin and $500 ethereum. I able to earn $6.34 total interest paid and estimate interest pay $1.76, the extra $200 is from referral bonus which I mention that with you later.

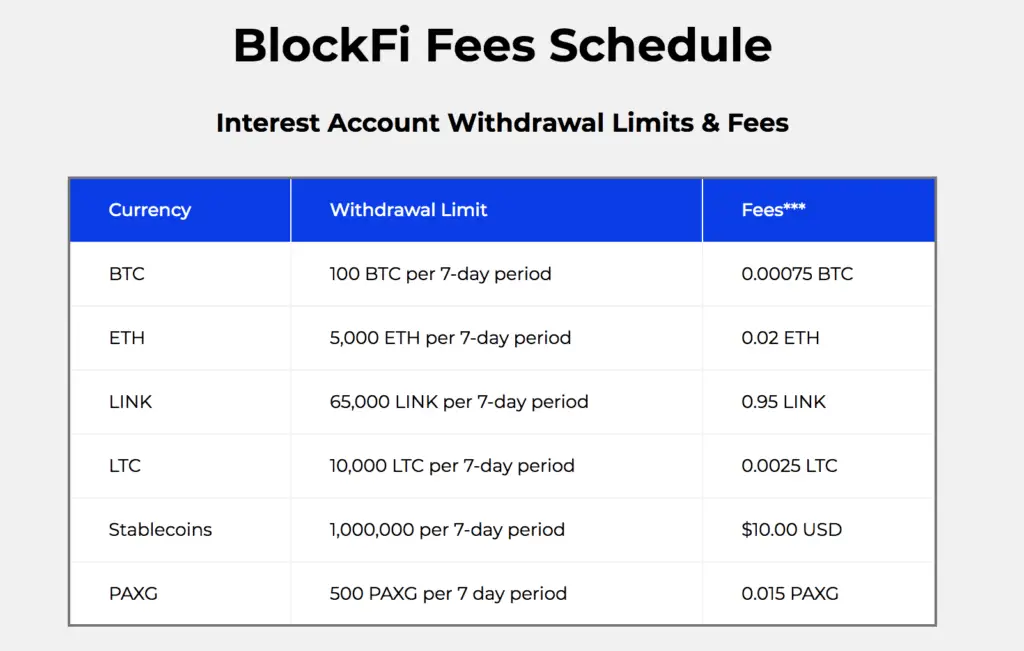

What are blockfi fees and withdrawal limited?

While there are no monthly fees for using BlockFi, the platform has withdrawal limits and fees.

It’s noteworthy that if you don’t plan on trading your crypto assets regularly, then you’ll pay a small amount or no fee at all. But if you want to make frequent withdrawals, BlockFi fees could add up quickly.

Here’s all the fees:

What are the risks of using Blockfi?

In the financial world there no such thing calls free lunch. Lending your money or borrowing money from BlockFi comes with risks. There are two risks you might counter.

Blockfi could get hacked

Like every crypto company managing users’ assets, BlockFi is a lucrative target for hackers. If BlockFi would be hacked, lenders could potentially lose their deposits and borrowers could lose the collateral they deposited against their loan.

To offset this risk, BlockFi outsourced the custody of users’ funds to a company called Gemini. This is a common practice in the crypto industry and actually a good sign.

Borrowers could default on their loans

As I mentioned before, all loans made by BlockFi are secured by collateral that borrowers have to deposit previous to taking out the loan. The value of the collateral always needs to exceed the value of the loan.

However, any collateral asset can fall in value whether it’s a house or a crypto asset such as bitcoin. If the value of the collateral drops very quickly, to an amount below the value of the loan, the borrower would have no incentive to pay back the loan.

To prevent this from happening, if you are a crypto lender you need to liquidate the collateral like take the money out if it falls under a certain ratio.

How to earn more money with this platform?

You can refer your friend joins this platform, you can get an additional $10 of BTC when the friend adds at least $100 to their BIA account.

The friend who was referred will also receive $10, but users that refer at least five people will start earning $20 in Bitcoin for each referral after that.

Now let’s talk about pro vs cons

Pro:

- High yield (8.6%) on your cryptocurrency deposits

- Gemini-insured wallets

- No monthly fees

- Ability to borrow against your crypto assets

- No minimum balance to earn interest

- No Balance caps

- Zero Fees Trading

Cons:

- Limited Asset Option

- Multiple Lowered Tier Rate

- Adjustable Interest Rate

- Monthly Payout

Now you might be wonder it is legit company? Or scam? I already do-little research for you. Let see what they said

Like This Post? Do Me a Favor and Share it!

And for more tips on how to make money online make sure you check out the following: